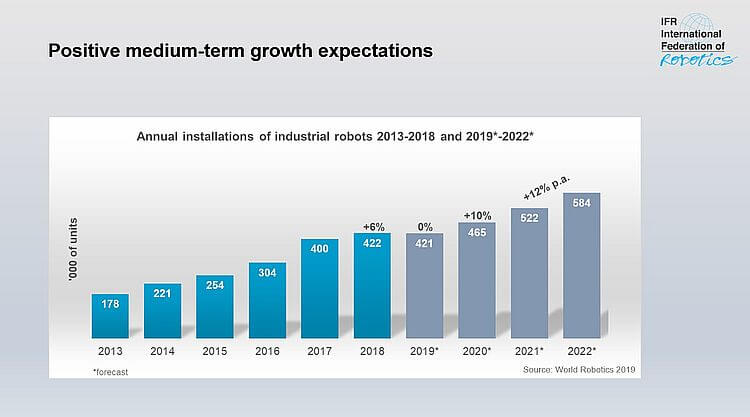

The latest International Federation of Robotics figures show global sales of US$16.5bn in 2018, with a total of 422,000 industrial robots shipped – up 6% compared to the previous year.

Asia maintained it’s position as the world’s largest market for industrial robots, though 2018 offered a mixed picture for the three largest Asian markets. Installations in China and the Republic of Korea declined, while Japan increased considerably.

Robot installations grew by 1% in Asia, and by 14% in the second largest market, Europe – a new peak for the sixth year in a row.

Growth rate across the Americas reached 20% more than the year before, which also marks a new record level for the sixth consecutive year.

Overall, IFR forecasts shipments in 2019 will recede from the record level in 2018, but expects an average growth of 12% per year from 2020 to 2022.

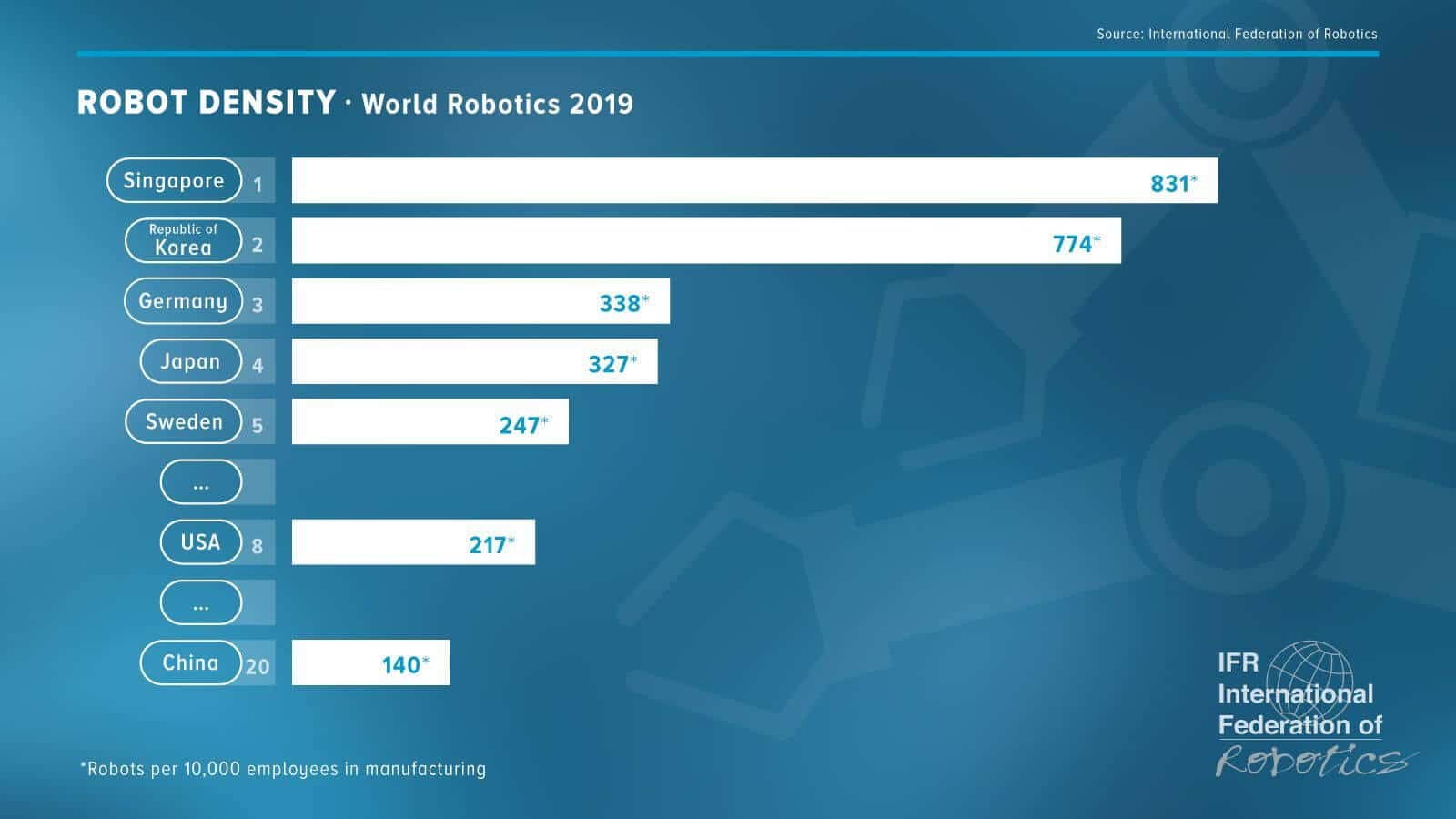

Top five markets in the world

Five major industrial robot markets represent 74% of global installations in 2018: China, Japan, Republic of Korea, the US and Germany.

China remains the world´s largest industrial robot market with a share of 36% of total installations. About 154,000 units were installed in 2018, which is 1% less compared to the previous year but more than the number of robots installed in Europe and the Americas together.

The value of installations reached US$5.4bn – 21% higher than in 2017.

Japan’s robot sales increased by 21% to about 55,000 units, the highest value ever for the country. The average annual growth rate of 17% since 2013 is remarkable for a market with an already highly automated industrial production, according to IFR.

Japan is the world´s number one industrial robot manufacturer and delivered 52% of the global supply in 2018.

A continued push to automate production in order to strengthen industries in both domestic and global markets saw robot installations in the US increase for the eighth year in a row to a new peak in 2018 – about 40,300 units.

That’s 22% higher than in 2017 and sees the US take the third position from the Republic of Korea.

Annual robot installations in the Republic of Korea declined by 5%. It’s robot market strongly depends on the electronics industry which experienced a tough year. Nevertheless, installations have increased by 12% on average per year since 2013.

Germany is the fifth largest robot market in the world and number one in Europe, followed by Italy and France. In 2018, the number of robots sold increased by 26% to almost 27,000 units – a new all-time record, mainly driven by the automotive industry.

Robot use by industry worldwide

The automotive industry remains the largest adopter of robots globally with a share of almost 30% of the total supply (2018).

After a very strong 2017, which saw a 21% increase of installations, the level was maintained and slightly increased by 2% in 2018. Investments in new car production capacities and in modernisation have also driven the demand for robots.

The electrical/electronics industry was about to replace the automotive industry as the most important customer for industrial robots in 2017.

However, in 2018, global demand for electronic devices and components substantially decreased.

The sector is among the most vulnerable to on-going US-China trade friction as Asian countries are leaders in manufacturing electronic products and components.

Robot installations in this industry declined by 14% from their peak level of about 122,000 units in 2017 to 105,000 units in 2018.

The metal and machinery industry established itself as the third largest customer industry, with installations accounting for 10% of total demand in 2018.

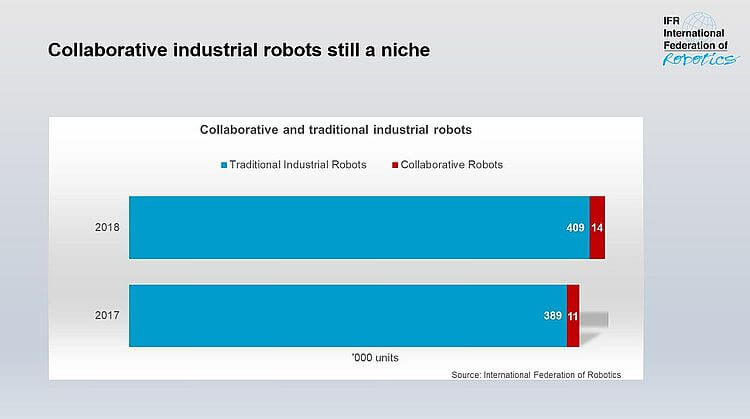

Robots designed for collaborative use

For the first time, World Robotics analyses the market for collaborative industrial robots (‘cobots’), designed to perform tasks in the same workspace as human workers.

The IFR definition implies that a cobot is necessarily an industrial robot as defined in ISO 8372:2012. Despite a very strong media attention of cobots, the number of units installed is still very low with a share of 3.24% only.

In 2018, less than 14,000 out of more than 422,000 industrial robots installed, were cobots. The year before that, roughly 11,100 units were cobots. From 2017 to 2018, annual installations of cobots increased by 23%.