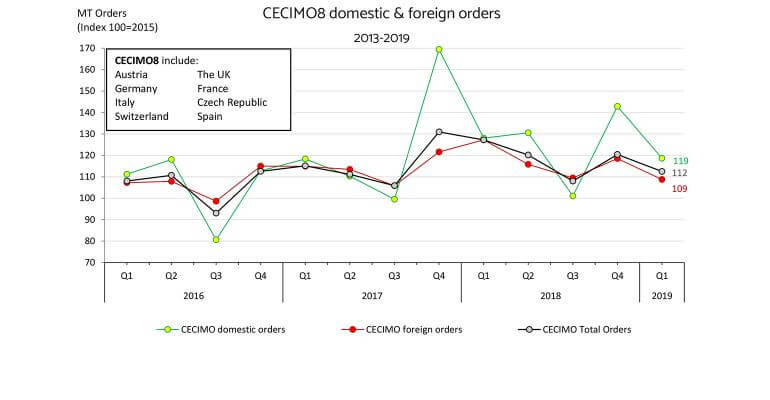

European machine tool producers’ new orders declined again in the first quarter of 2019, according to the latest quarterly report by CECIMO – the European Association for the Machine Tool Industries and Related Manufacturing Technologies. Production of machine tools in Europe is expected to be flat in 2019, according to the same report.

The eight largest European machine tool manufacturing nations registered a -14% drop in orders volume during Q1, compared to comparable period of last year. Foreign demand has been affected to a larger extent (-17%) than domestic orders (-10%.)

Within individual nations, the sharpest declines in total orders were registered in the Czech Republic (-27%), Germany (-20%) and Spain (-16%). More moderate declines were recorded in Italy (-7%) and Switzerland (-4%). The U.K. saw a +15% increase.

Domestic new orders declined in Spain (-49%), Austria (-20%), Czech Republic (-12%), Germany (-9%), and Italy (-9%.)

U.K. machine-tool manufacturers reported a +10% increase in domestic demand.

Demand from foreign customers dropped sharply in Czech Republic (-31%) and Germany (-26%). U.K. manufacturers posted a +19% increase in foreign demand, while Austrian producers reported +3% growth in orders from outside the country.

According to the CECIMO report, weaker trade volumes, low business confidence, and geopolitical risks are weighing on demand for the European machine tools. Manufacturers are starting to see the consequences of slower trade on their business, the report indicated.

In its forecast for the remainder of 2019, CECIMO expects 2019 machine tool production to rise by just 2%, down from the +9% in 2018, and machine-tool consumption to grow 1-2%, compared to the 9% expansion for 2018.

About CECIMO

The European Association of the Machine Tool Industries and Related Manufacturing Technologies (CECIMO) is comprised of the trade associations for 15 countries, which represent approximately 1,500 business in Europe (EU, plus EFTA and Turkey), and 98% of the total machine tool production in Europe and about 33% worldwide.

Over 75% of CECIMO production is shipped abroad, and half of it is exported outside Europe.

For more information on the latest developments in the European machine-tool sector, check CECIMO’s latest Quarterly Economic and Statistical Toolbox for Q1 2019, or contact information@cecimo.eu.