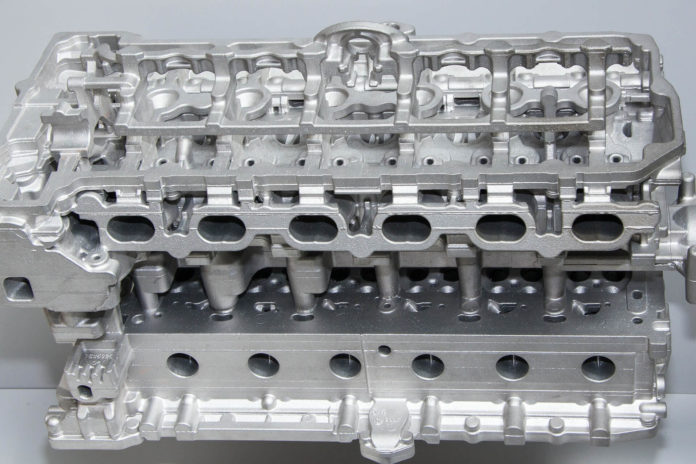

Changing automotive marketplace and fewer vehicle launches are driving reduced regional spending by automakers.

A newly released analysis of the automotive-vendor tooling sector indicates that spending in the North American market will decline to $6.8 billion in 2020 from an estimated $8.7 billion this year, a drop of nearly -28% year over year. The primary factor shaping the market is the decreasing number of North American vehicles to be sourced for production in 2020, a total of 45, according to Harbour Results Inc.

The HRI Harbour IQ study examines the automotive-vendor tooling sector and the trends shaping it.

“This year, 2019, was a culmination of significant change and instability in the automotive marketplace,” according to Laurie Harbour, who founded and heads the manufacturing business and operations consulting firm.

From unique mobility models and new automakers to advancing electrification and autonomous technologies to uncertainty in the economy and global trade landscape, the only thing we are certain of is that the industry will continue to change at a rapid rate.

“This is impacting automaker profitability,” she continued, “which means platforms will be commonized, trim models will be eliminated, and OEMs will be leveraging reductive design to save money. These factors are significantly impacting the health of the North American tool-and-die industry and resulting in reduced tooling spend.”

Of the total number of vehicles to be sourced in 2020, the Detroit Three automakers are seen sourcing just 13 vehicles, representing approximately $3.1 billion in tooling spend.

The forecast for North American tooling spend in 2021 is $7.3 billion.

“This forecast is difficult for us to share,” according to Harbour. “However, the ongoing marketplace change and competition from low-cost countries – specifically China – has already impacted tool and diemakers. In 2019 we saw at least 10 shops close and more than 2,000 workers laid off —and we see this trend continuing.”

HRI forecasts regional automotive tooling spending will decline from an annual average of $8-10 billion to $6.5-8 billion during the 2022-2024 period. The reduced spending and consequent economic instability will mean up to 75 mold and die shops in the region will close during that time, according to Harbour Results.

“As the tooling market contracts, it is important that shops position themselves for the future. Leadership needs to push for edginess and eliminate complacency, and it also is important that tool shops continue to put plans in place to shore up weaknesses, maximize technology and talent, and control costs,” Harbour said.