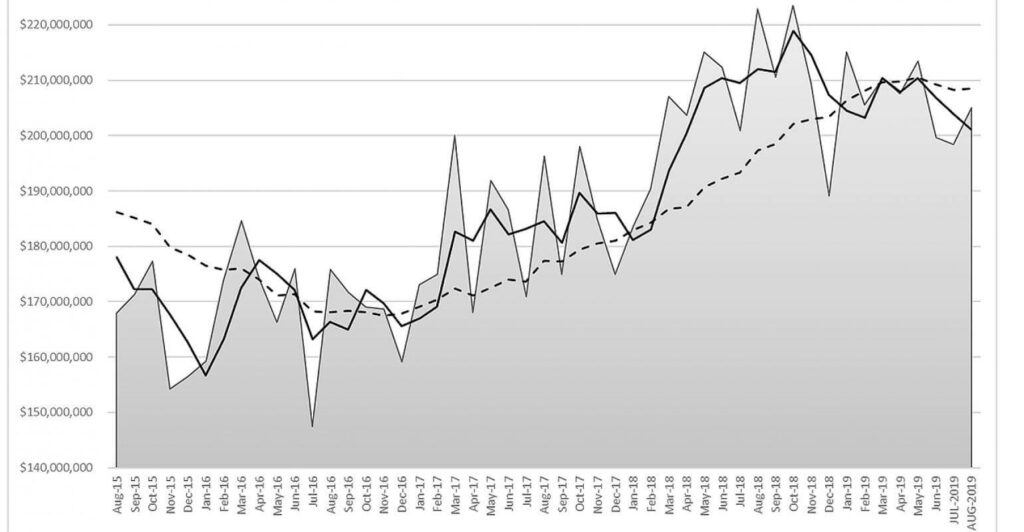

U.S. cutting tool consumption increased 3.3% from July to August, but the index to manufacturing activity continues to fall behind the year-over-year and year-to-date marks.

Machine shops and other U.S. manufacturers purchased $205.1 million during August 2019, 3.3% more than the total for July but -8.0% less than the order for August 2018. The eight-month total for 2019 cutting-tool consumption is $1.7 billion, 1.2% more than the total for January-August 2019.

Source: AM

“While 2019 year-to-date market remains positive, the gain is deteriorating and may turn negative before year end as there are a number of reports now showing an overall manufacturing slow down,” according to U.S. Cutting Tool Institute president Phil Kurtz.

The data is supplied by the Cutting Tool Market Report issued monthly by USCTI and AMT – the Association for Manufacturing Technology, and consists of actual order values reported by participating cutting-tool suppliers who represent a majority of the domestic market.

The CTMR offers perspective on the rate of manufacturing activity, as cutting tools are the primary consumable product for machine shops and other manufacturers.

“The weakening economic outlook drives softening industrial production, manufacturing output, and business spending. This means that the U.S. benefit from rising inventories is over and inventory liquidation has begun. With industrial production likely to continue to be sluggish for the foreseeable future, most manufacturing has begun an inventory liquidation of short-cycle components,” commented Eli Lustgarten, president of ESL Consultants, an analyst quoted by the CTMR authors.

He pointed out that cutting-tool demand has shown month-to-month volatility throughout the current year, but that the monthly YTD increases peaked in January.

And, he predicted that the cutting-tool demand would decelerate, or even contract, for the remainder of 2019 and early 2020.